FuboTV (FUBO)·Q1 2026 Earnings Summary

Fubo Delivers First Post-Merger Results: Pro Forma EBITDA Surges 88%, ESPN Deal Announced

February 3, 2026 · by Fintool AI Agent

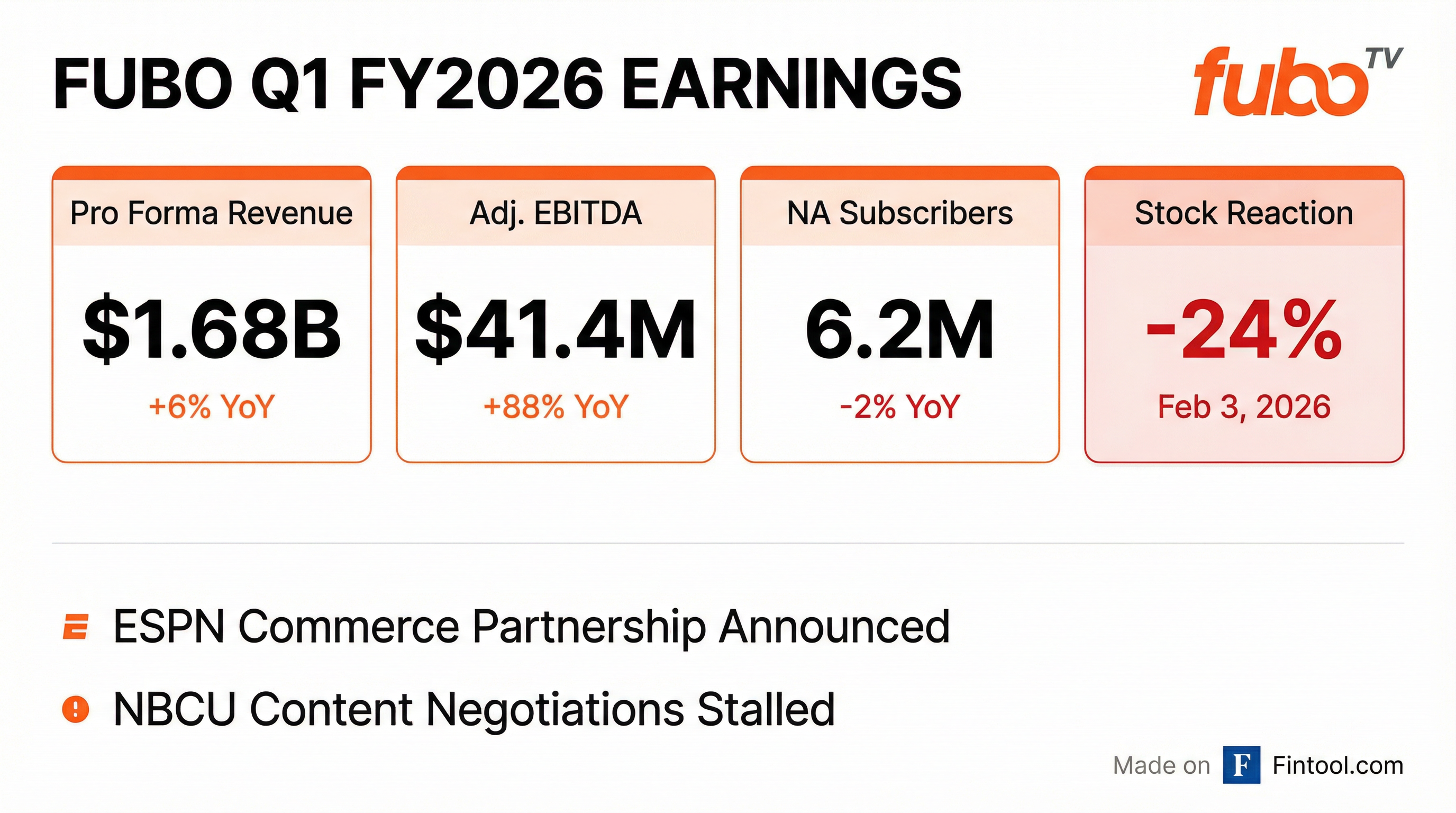

Fubo (NYSE: FUBO) reported Q1 FY2026 results today—its first full quarter following the transformative October 2025 merger with Disney's Hulu + Live TV business. The combined company delivered $1.68B in pro forma revenue (+6% YoY) and $41.4M in pro forma adjusted EBITDA (+88% YoY), while announcing a strategic reseller partnership with ESPN that could accelerate subscriber growth.

Despite the improving profitability trajectory and ESPN partnership, shares fell 24% to $1.70 on heavy volume (15M+ shares), as investors focused on the lack of guidance and ongoing NBCU negotiations uncertainty. The stock opened at its high of $2.23 and sold off throughout the session.

How Did Fubo Perform This Quarter?

This quarter marks a reset for Fubo. Due to reverse acquisition accounting (with Hulu Live Business as the accounting acquirer), direct beat/miss comparisons to pre-merger analyst estimates are not meaningful. Management provided both reported and pro forma results to facilitate comparability.

The pro forma adjusted EBITDA margin expanded to 2.5% from 1.4% in the year-ago quarter—a 110 basis point improvement reflecting early synergy capture from the combination.

What's the ESPN Deal About?

Perhaps the most significant announcement was Fubo's plans for a reseller and marketing arrangement with ESPN—one of the most powerful sports media brands in the world.

Key details:

- Fubo Sports (which already includes ESPN Unlimited, FOX, and CBS programming) will be available for purchase directly within ESPN's commerce flow

- ESPN will feature Fubo across "various placements" on ESPN digital properties

- Per comScore, ESPN reached more than 4 out of 5 U.S. adults in November 2025

- The arrangement is subject to negotiation of definitive agreements

Management expects this partnership to lower customer acquisition costs and position Fubo as "the premier destination for fans." Given ESPN's massive reach, even modest conversion rates could move the needle on subscriber additions.

How Did the Stock React?

Fubo shares sold off sharply on earnings day despite the positive EBITDA and ESPN news:

The sell-off likely reflects: (1) no formal guidance provided, (2) Comcast refusing to engage in NBCU renewal discussions, and (3) concerns about subscriber trends despite the ESPN partnership. The stock is now down 64% from its 52-week high.

What Changed From Last Quarter?

Several important developments since the Q4 FY2025 report (Q3 calendar 2025):

1. Hulu + Live TV Merger Closed (Oct 29, 2025)

The combination created the 6th largest Pay TV company in the U.S. with 6.2 million subscribers. Fubo now owns Hulu + Live TV (entertainment-focused), Fubo (sports-focused), and Molotov (international). The company is now an affiliate of The Walt Disney Company.

2. NBCU/Versant Content Removed

In late November, Fubo removed programming from NBCUniversal and Versant from the Fubo service and offered affected subscribers a price reduction. Management noted subscriber impact was "better than our expectations"—validating their sports-first value proposition.

3. Disney Ad Server Migration

The migration of Fubo's ad tech stack into the Disney Ad Server is expected to complete this month. Once live, Fubo inventory will be packaged and sold alongside premium Disney+, ESPN+, and Hulu inventory. Management expects "meaningful uplift in both CPMs and fill rates."

4. Reverse Stock Split Announced

The board approved a reverse stock split at a ratio between 1:8 and 1:12, intended to make shares "more accessible to a broader base of investors." Effective date expected later this quarter.

What Did Management Guide?

Management declined to issue formal guidance, citing the need for "better visibility on the timing and impact of our combined company initiatives."

However, CEO David Gandler's shareholder letter outlined the strategic focus for FY2026:

"2026 is the year of scaling with purpose. With the integration well underway, we are focused on expanding our reach, driving higher yields through our combined ad tech, and enforcing portfolio discipline to maximize margins."

Key priorities mentioned:

- Complete Disney Ad Server migration (expected this month)

- Execute ESPN reseller partnership

- Accelerate product roadmap for "consumer-centric innovations"

- Continue portfolio discipline (content cost optimization)

What Are the Key Metrics to Watch?

Subscriber Trends: NA subscribers declined 2% YoY to 6.2M on a pro forma basis. The NBCU content removal had less impact than feared, but sustaining/growing the base will be critical. Quarterly sequential trend shows recovery from the Q3 trough (5.6M).

Advertising Revenue: Pro forma advertising revenue was $123.5M, down from $128.7M YoY (-4%). The Disney Ad Server migration is the key catalyst here—packaged inventory with premium Disney properties should drive higher CPMs.

Pay-Per-View: Fubo launched Pay-Per-View in 2025 and saw a 200% increase in sales Q/Q driven by UEFA European Qualifiers to FIFA World Cup 2026. This emerging revenue stream validates the "super-fan" monetization thesis.

What Did Analysts Ask on the Call?

The Q&A session provided important context on synergies, content negotiations, and growth priorities:

On NBCU Negotiations: David Gandler revealed that Comcast has refused to engage in renewal discussions for the Fubo service, preferring to wait until the Hulu Live contract expires. Despite losing NBC content for 4+ weeks, Fubo grew standalone subscribers 3% YoY. Management noted: "subscriber impact to date has been modest since the removal of NBC content and better than our expectations."

On Synergy Timeline: CFO John Janedis outlined $120M+ in expected synergies across three categories:

- Disney Ad Server integration (near-term) — CPM and fill improvement both in "double digits" on Fubo's ~$100M standalone ad revenue base

- Content/programming (medium-term) — as contracts renew

- Procurement (third category) — "in very early stages" but could be a "needle mover"

On Fubo Sports Performance: The skinnier Fubo Sports package ($44.99-$45.99) is exceeding expectations. Management noted: "retention is actually about 30% above what the legacy plan is" — a positive sign for the value-oriented sports bundle strategy.

On Balance Sheet Evolution: A notable improvement: Two years ago Fubo had $400M debt maturing February 2026. Now they have $320M outstanding maturing in 2029/2031, with adjusted EBITDA swinging from a $86M loss in 2024 to positive $78M in calendar 2025.

On YouTube TV/Disney Blackout: When asked about subscriber benefit from the Disney-YouTube TV dispute, management stated the impact was "immaterial to the overall platform."

On Disney CEO Succession: During the call, Needham analyst Laura Martin noted Disney had just announced Josh D'Amaro as the next CEO to succeed Bob Iger—signaling Disney is positioning as a "parks company, not an entertainment company." Gandler responded that relationships with ESPN and Hulu teams remain strong and he doesn't "see any changes in the short term."

On Guidance: Management declined to provide guardrails, citing factors still being refined (ESPN deal timing, NBC programming status). "We're only 98 days into this combination, so it's just going to take us a little bit more time."

What Are the Risks?

-

Content Cost Inflation: Live sports rights remain expensive. Fubo must balance programming breadth with margin discipline.

-

Integration Execution: Merging two large streaming platforms involves technology, content, and organizational complexity. Disney Ad Server migration is a near-term test.

-

Subscriber Churn: The NBCU removal went better than expected, but future content decisions could be riskier. Competitors continue to invest heavily.

-

Capital Structure: With a ~$610M market cap (post-selloff) and $459M cash, Fubo has runway but operates in a capital-intensive industry. The reverse split suggests management is concerned about share price perceptions.

-

ESPN Deal Contingencies: The reseller arrangement is "subject to negotiation of definitive agreements"—not a done deal yet.

Bottom Line

The operational results were solid—88% EBITDA growth, manageable NBCU subscriber impact, and a promising ESPN partnership. But the 24% stock decline signals investors want more visibility before getting constructive.

Key concerns driving the sell-off: (1) Comcast's refusal to engage in NBCU renewal discussions creates content uncertainty, (2) no formal guidance despite being "98 days" into the merger, and (3) North America subscribers still down 2% YoY despite the ESPN announcement.

The bull case hinges on: Disney Ad Server CPM lift (double-digit improvement expected), ESPN commerce flow driving lower-CAC subscriber growth, and the Fubo Sports bundle showing 30% better retention than legacy plans.

The next few quarters will determine whether Fubo can execute on these synergies while navigating the NBCU standoff. Until management provides guidance and the ESPN deal closes, the stock will likely remain volatile.